Banks and Other Financial Institutions Engage in Financial Intermediation Which

Financial intermediaries function basically by connecting an entity with a surplus fund to a deficit fund. And 3 how interventions by firms governments and other parties affect the provision of financial.

Banks As Financial Intermediaries Introduction To Business

Pre-Positioning and Cross-Border Financial Intermediation.

. The history of banking began with the first prototype banks that is the merchants of the world who gave grain loans to farmers and traders who carried goods between cities. They ease the money flow Money Flow Money flow MF refers to a mathematical function used to analyze changes in the value of a security by multiplying its typical price by daily trading volume. Structure and Share Data for US.

Specifically Household Finance studies 1 how households make financial decisions relating to the functions of consumption payment risk management borrowing and investing. The DiamondDybvig model demonstrates how financial intermediation by banks performed by accepting assets that are inherently illiquid and offering liabilities which are much more liquid offer a smoother pattern of returns can make banks. So it is crucial to understand what EMI.

Modern Treasury has built a platform to complement banks existing products to help them prepare for a future led by software. These risks are heightened when the identities of a foreign financial institutions underlying. This was around 2000 BCE in Assyria India and SumeriaLater in ancient Greece and during the Roman Empire lenders based in temples gave loans while accepting deposits and performing the change of.

Bank liabilities and the structure of financial intermediation. Statistics Reported by Banks and Other Financial Firms in the United States. Already technological regulatory and competitive forces are moving markets toward easier and safer financial data sharingOpen-data initiatives are springing up globally including the United Kingdoms Open Banking Implementation Entity the European Unions second payment services directive Australias new consumer protection laws Brazils drafting of open.

It covers important theoretical concepts and recent developments in financial intermediation asset pricing under asymmetric information behavioral finance and market microstructure. Shadow Banking System. Other financial corporations include insurance corporations pension funds other financial interme-diaries and financial.

This was faster than the global NBFI sector comprising mainly pension funds insurance corporations and other financial intermediaries OFIs1 which experienced asset growth of 79 reaching 2266 trillionThe faster growth in bank central bank and public. The purpose of this paper is to seek the views comments of banks non-banking financial institutions for-profit companies regulators academicians NGOs and the public at large on the discussion on whether there is a case for allowing banks to engage for-profit companies as well as NBFCs as their Business Correspondents for expanding their banking. 1 This will raise questions about banks and.

One of the earliest and most influential models of liquidity crisis and bank runs was given by Diamond and Dybvig in 1983. This bulletin highlights for broker-dealers various risks arising from illicit activities associated with transactions in low-priced securities through omnibus accounts particularly transactions effected on behalf of omnibus accounts maintained for foreign financial institutions. The latter function can be broken down further into two parts.

Total global financial assets exhibited strong growth in 2020 increasing by 109 to 4687 trillion. After all when I have an established relationship with a software offering theres less of a need for the payment intermediation offered by the credit card rails. 2 how institutions provide goods and services to satisfy these financial functions of households.

For instance banks non-bank financial institutions and Fintech firms not the World Bank are leading the push for digital financial inclusion in a bid to reach billions of new customers by offering digital financial services to the mobile and digital device of the excluded and underserved population in exchange for a fee. A shadow banking system refers to the financial intermediaries involved in facilitating the creation of credit across the global financial system but whose members are not. Modern Treasury Can Help.

The Islamic financial system is not limited to banking but covers insurance capital formation capital markets and all types of financial intermediation and suggests that moral and ethical aspects in the regulatory framework are also necessary in addition to prudent and sound controls. Financial intermediation or in auxiliary financial activities that are closely related to financial interme-diation but are not classified as deposit takers6 Their importance within a financial system varies by coun-try. Such institutions are best known for e-money disbursement and payment intermediation which contribute to the total value of digital payments around 6752388 in 2021 and is expected to hit 10715390 by 2025.

An electronic money institution EMI is a symbol of the evolution of financial services. The Sustainable Finance Group SFG in the Department of Regulation DoR Reserve Bank of India RBI carried out a survey 1 in January 2022 to assess the status of climate risk and sustainable finance in leading scheduled commercial banks 2. Traditionally central banks have for various reasons tended to limit access to digital account-based forms of central bank money to banks and in some instances to certain other financial or.

Read more in the economy and support. Often they discreetly advertise by sticking notices mostly on lamp posts and utility boxes around a. The responses indicate that although banks have begun taking steps in the area of climate risk and.

Offices of Foreign Banks. I If the FDIC determines that a particular common equity tier 1 additional tier 1 or tier 2 capital element has characteristics or terms that diminish its ability to absorb losses or otherwise present safety and soundness concerns the FDIC may require the FDIC-supervised institution to exclude all or a portion of such element from common equity. Financial Accounts of the United States - Z1.

Role of Financial Intermediary. This course studies financial institutions and focuses on the stability of the financial system. Ah Long derived from the Cantonese phrase 大耳窿 big ear hole is a colloquial term for illegal loan sharks in Malaysia and SingaporeThey lend money to people who are unable to obtain loans from banks or other legal sources mostly targeting habitual gamblers.

What is Islamic finance. First to bring together those with excess money savers investors and those without it borrowers enterprises which is typically done through financial intermediation the inner workings of banks or financial markets such as stock or bond markets.

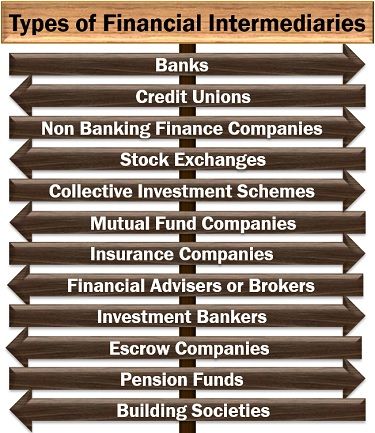

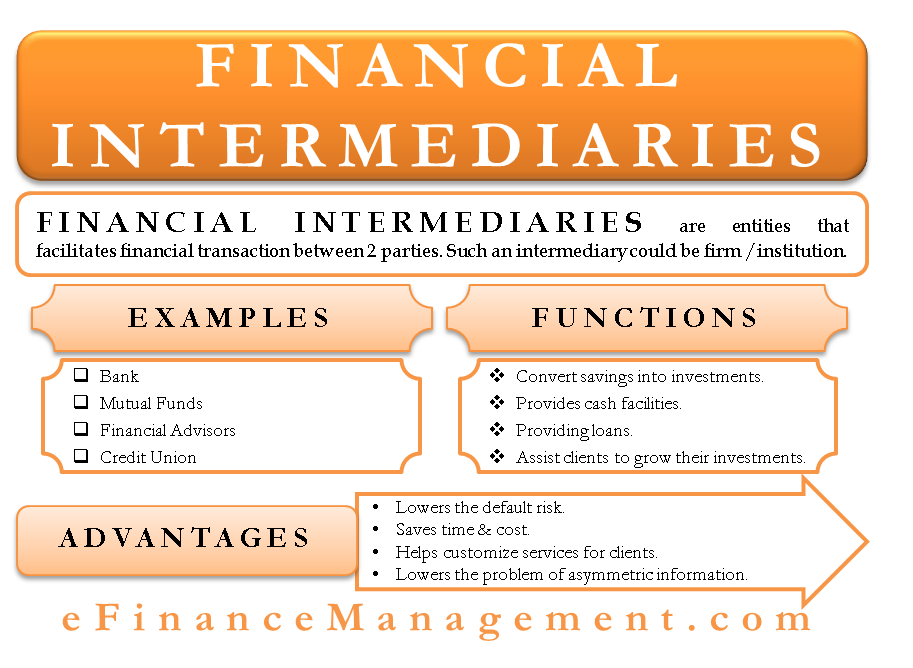

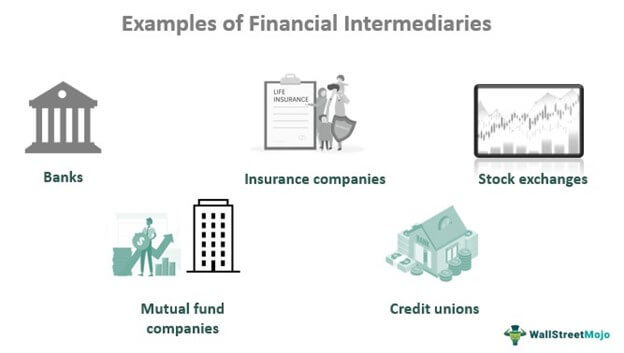

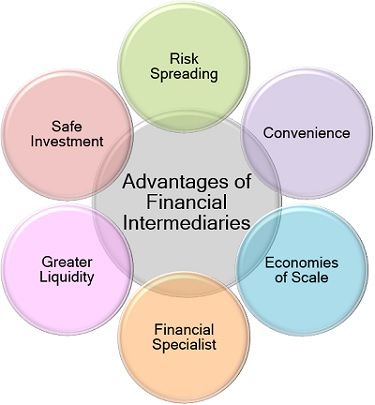

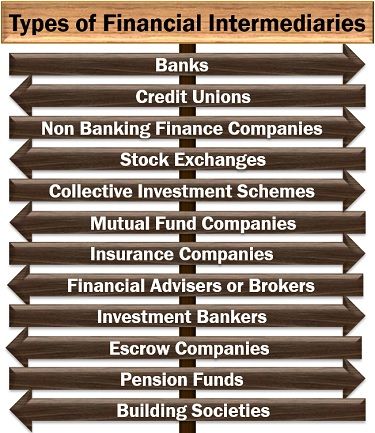

Financial Intermediaries Meaning Functions And Importance Efm

Financial Intermediary Definition Role Types Examples

:max_bytes(150000):strip_icc()/dotdash-investmentbank_vs_merchantbank-Final-919a2920abc645518abb9c8620ae5cad.jpg)

Investment Banks Vs Merchant Banks What S The Difference

What Are Financial Intermediaries Definition Example Types Advantages Drawbacks The Investors Book

What Are Financial Intermediaries Definition Example Types Advantages Drawbacks The Investors Book

Financial Intermediary Learn How Financial Transactions Work

0 Response to "Banks and Other Financial Institutions Engage in Financial Intermediation Which"

Post a Comment